Budget 2025-26 drives India’s economic growth through investments in agriculture, MSMEs, infrastructure, and exports.

Introduction

The Budget 2025-26 continues the government’s commitment to driving economic growth, ensuring inclusive development, boosting private sector investments, uplifting household sentiments, and increasing the spending power of India’s rising middle class. This budget provides a well-structured roadmap for achieving a Viksit Bharat under the leadership of Prime Minister Narendra Modi.

Despite global economic uncertainties, India remains the fastest-growing major economy. The country aims to eradicate poverty, provide 100% access to quality education, ensure affordable healthcare, create employment opportunities, and empower women economically. Furthermore, the budget focuses on four key sectors—Garib (Poor), Youth, Annadata (Farmers), and Nari (Women).

For the latest unbiased news updates on India’s economic policies, visit Suchak News.

Budget 2025-26: Key Economic Growth Strategies & Development Themes

This year’s budget builds upon four growth engines:

- Agriculture Growth in Budget 2025-26: Strengthening Farmers & Rural Economy

- MSME Development & Support: Strengthening Small Businesses & Entrepreneurship

- Investment & Infrastructure Development: Driving Economic Growth in 2025

- Export Promotion & Trade Expansion: Strengthening India’s Global Market Presence

The budget also introduces six major reform domains:

- Taxation Reforms 2025: New Income Tax Slabs & Compliance Simplifications

- Power Sector Policies for Energy Security

- Urban Development & Sustainable Cities

- Mining & Resource Utilization Strategies

- Financial Sector Enhancements

- Regulatory Reforms: Ease of Doing Business & Policy Overhaul

Agriculture Growth in Budget 2025-26: Strengthening Farmers & Rural Economy

PM Dhan-Dhaanya Krishi Yojana: Boosting Agricultural Productivity & Rural Development

This initiative will focus on 100 districts with low productivity, improving irrigation, storage, and credit facilities. Notably, around 1.7 crore farmers will benefit.

Rural Prosperity & Resilience Program

This program creates employment in rural areas by enhancing skill development, technological advancement, and economic opportunities. As a result, it reduces forced migration from villages.

Mission for Aatmanirbharta in Pulses

A six-year plan focusing on self-sufficiency in Tur, Urad, and Masoor dal will be implemented. The government will ensure procurement and pricing support through agencies like NAFED and NCCF.

To learn more about India’s agricultural growth initiatives, visit the Ministry of Agriculture & Farmers’ Welfare.

MSME Development & Support: Strengthening Small Businesses & Entrepreneurship

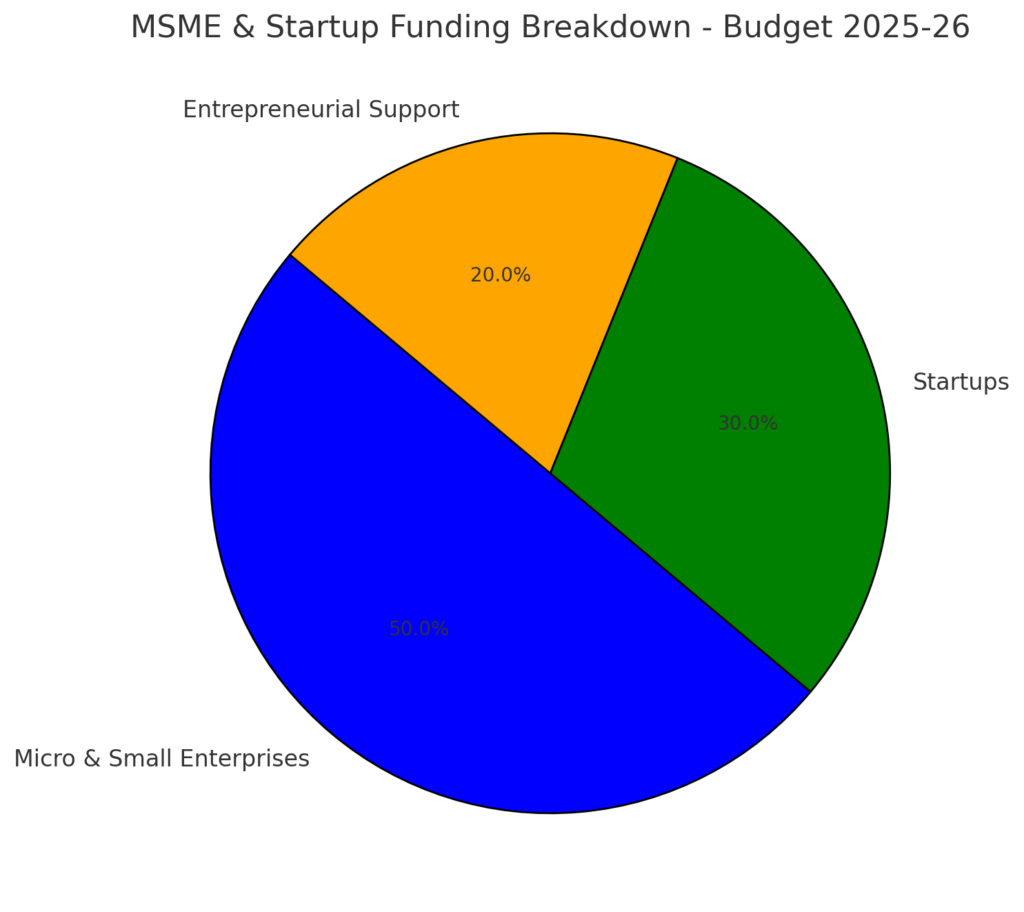

Revised MSME Classification

The government has increased investment and turnover limits for MSMEs by 2.5 times to help them grow and create employment. This change enables small businesses to operate with greater flexibility.

Enhanced Credit Availability

- Micro & Small Enterprises: ₹5 crore → ₹10 crore

- Startups: ₹10 crore → ₹20 crore

- Exporting MSMEs: Term loan limit raised to ₹20 crore.

Credit Cards for Micro Enterprises

The government will introduce customized ₹5 lakh credit cards for micro-enterprises, making credit more accessible.

Support for First-Time Entrepreneurs

The scheme will provide ₹2 crore loans to 5 lakh women, SC, and ST entrepreneurs, fostering an inclusive entrepreneurial ecosystem.

For additional MSME support details, check the Ministry of Micro, Small & Medium Enterprises.

Investment & Infrastructure Development: Driving Economic Growth in 2025

Investing in People

- Poshan 2.0: Nutritional support for 8 crore children and 1 crore pregnant women.

- Atal Tinkering Labs: Establishing 50,000 innovation labs in schools.

- Medical Education: Adding 10,000 new UG & PG medical seats.

- Cancer Treatment: Setting up daycare cancer centers in every district.

Export Promotion & Trade Expansion: Strengthening India’s Global Market Presence

Export Promotion Mission

This initiative supports MSME exports and increases India’s global trade penetration.

BharatTradeNet

A digital trade platform will streamline trade documentation and financing, making transactions seamless.

Warehousing for Air Cargo

The government will establish cold storage and processing units at airports to improve export efficiency and ensure product quality.

Economic Reforms 2025: Taxation, Regulatory Changes & Growth Policies

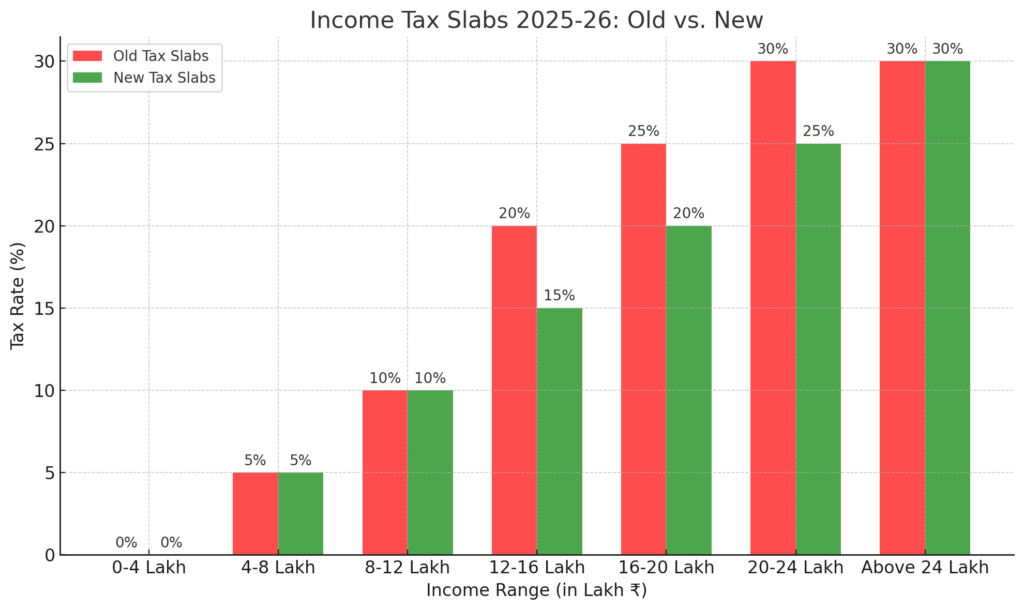

Taxation Reforms 2025: New Income Tax Slabs & Compliance Simplifications

- No income tax for earnings up to ₹12 lakh.

- New tax slabs:

- ₹0-4 lakh: Nil

- ₹4-8 lakh: 5%

- ₹8-12 lakh: 10%

- ₹12-16 lakh: 15%

- ₹16-20 lakh: 20%

- ₹20-24 lakh: 25%

- Above ₹24 lakh: 30%

Conclusion

The Budget 2025-26 provides a clear roadmap for India’s development, with a strong emphasis on agriculture, MSMEs, infrastructure, and exports. With pro-growth policies, tax benefits, and major investments, the government aims to strengthen India’s position as a global economic leader while ensuring sustainable and inclusive growth.

For the latest updates on India’s economic policies, visit Suchak News.

1 thought on “Budget 2025-26: A Comprehensive Overview in Simple Language”