A symbolic representation of the 8th Pay Commission highlighting salary revisions, fairness, and its impact on government employees in India.

The 8th Pay Commission represents a significant milestone in revising the salaries, pensions, and allowances for central government employees in India. The Union Government established it, and its recommendations are expected to take effect starting January 1, 2026. Moreover, these recommendations will impact millions of employees and pensioners, making it a pivotal topic of national interest.

What is the 8th Pay Commission?

The 8th Pay Commission is a government-appointed body tasked with reviewing and revising pay scales, allowances, and pensions for central government employees. Furthermore, it evaluates the socio-economic conditions of employees and suggests reforms to improve their financial stability. Compared to previous pay commissions, this one aims to address inflation, rising living costs, and disparities in salary structures.

For instance, the government has proposed increasing the fitment factor, a multiplier used to calculate revised salaries. Consequently, employees could see significant hikes in their take-home pay, ensuring better alignment with current economic realities. However, these revisions pose their own set of challenges, both economic and political.

Why Does the Modi Government See It as a Necessity?

The Modi government considers the 8th Pay Commission essential for ensuring the financial well-being of government employees. Moreover, increasing salaries and pensions boosts employee morale, productivity, and retention in public sector roles. Additionally, higher disposable incomes stimulate consumer spending, thereby driving economic growth.

Furthermore, the government sees this as an opportunity to bridge existing wage disparities and address long-standing demands from employee unions. For example, employee unions have consistently called for timely revisions to mitigate the effects of inflation. As a result, the Modi government aims to create a balanced framework that meets these demands while maintaining fiscal responsibility.

What Are the Opposition’s Concerns?

However, the opposition has raised significant concerns regarding the fiscal implications of the 8th Pay Commission. Critics argue that the additional expenditure on salaries and pensions could strain the government’s budget. Consequently, this may divert resources away from critical sectors such as healthcare and education.

For instance, opposition leaders claim that previous pay commissions have led to ballooning fiscal deficits. Therefore, they demand greater transparency in how the government plans to manage these financial obligations. Additionally, they argue that the commission’s recommendations may disproportionately benefit higher-grade employees, leaving lower-grade workers with marginal improvements.

How Is the Opposition Supporting Its Argument?

The opposition cites data from previous pay commissions to highlight potential economic risks. For example, they point to rising fiscal deficits following the implementation of the 7th Pay Commission. Moreover, economic analysts warn that excessive government spending could lead to inflationary pressures, further eroding the benefits of salary hikes.

Additionally, some experts argue that the commission should focus on broader reforms, such as improving working conditions and providing skill development opportunities. Consequently, this approach could ensure long-term benefits for employees without overburdening the government’s finances.

Expert Opinions on the 8th Pay Commission

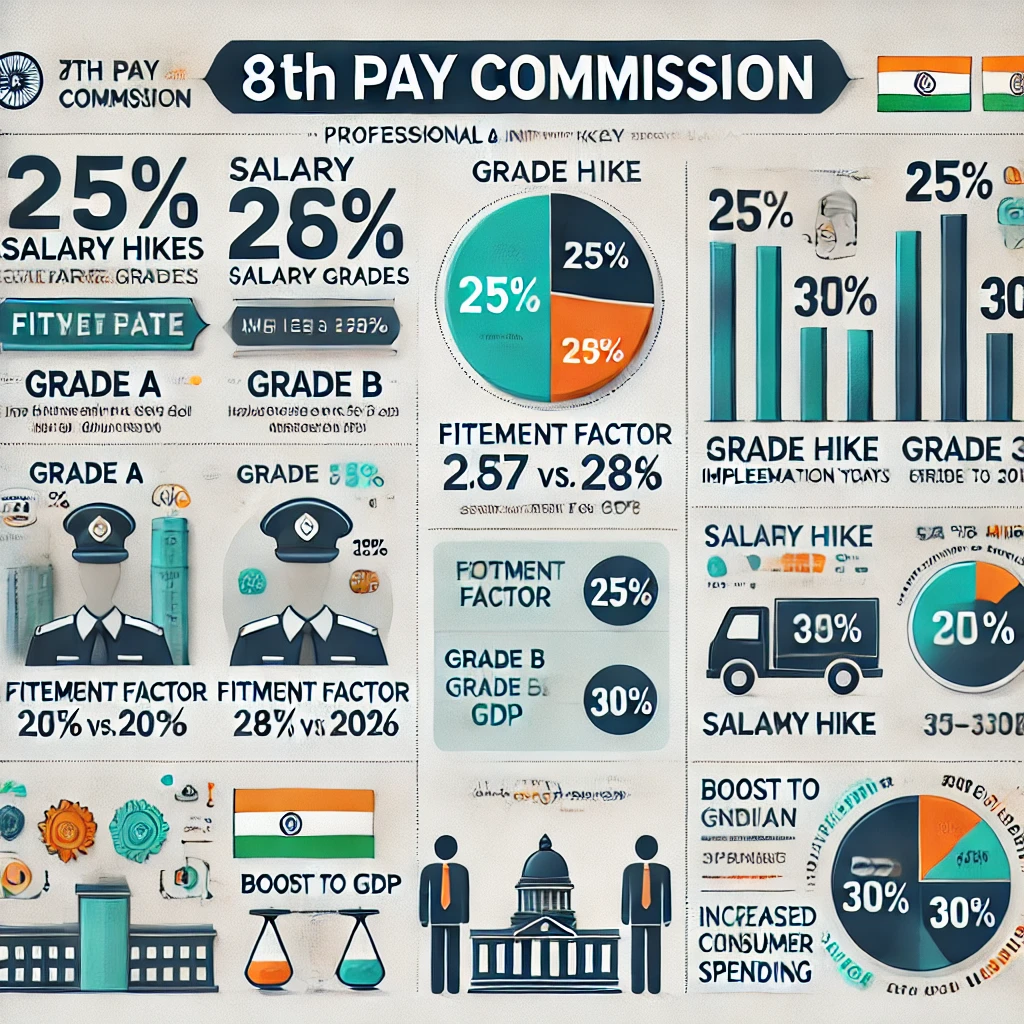

Economic experts express divided opinions on the implications of the 8th Pay Commission. Some believe that it is a necessary step to address economic disparities among government employees. For instance, increasing the fitment factor from 2.57 to 3.0 could result in a substantial increase in salaries, thereby improving employees’ purchasing power.

On the other hand, critics caution against the potential economic fallout. They argue that the government must carefully balance employee demands with fiscal sustainability. As a result, they recommend phased implementations and targeted reforms to mitigate financial risks.

Economic Implications of the 8th Pay Commission

The implementation of the 8th Pay Commission will likely have far-reaching economic implications. Firstly, it could boost consumer spending, thereby contributing to GDP growth. Additionally, higher salaries may lead to increased savings and investments among employees, further strengthening the economy.

However, the financial burden on the government cannot be ignored. For instance, increased expenditure on salaries and pensions could limit the government’s ability to invest in critical infrastructure and social welfare programs. Consequently, careful planning and execution will be essential to ensure long-term economic stability.

Controversies and Delayed Announcements

The delay in announcing the 8th Pay Commission has caused dissatisfaction among government employees. Initially, the government hesitated to form the commission, citing fiscal constraints. However, consistent pressure from employee unions finally prompted the announcement in early 2025.

Nevertheless, critics argue that the delay reflects the government’s inability to prioritize employee welfare. Furthermore, they claim that timely announcements and implementations are crucial to maintaining employee trust and morale.

FAQs on the 8th Pay Commission

What is the fitment factor in the 8th Pay Commission?

The fitment factor is a multiplier used to calculate revised salaries. For example, if the current basic pay is ₹10,000 and the fitment factor increases to 3.0, the revised salary will be ₹30,000.

When will the 8th Pay Commission be implemented?

The 8th Pay Commission is expected to take effect from January 1, 2026.

How much salary hike is expected?

Reports suggest that employees could see a salary hike ranging from 25% to 30%, depending on their grade and position.

Conclusion

In conclusion, the 8th Pay Commission represents a crucial step in addressing the financial needs of central government employees. Moreover, its implementation has the potential to stimulate economic growth and improve employee morale. However, balancing these benefits with fiscal sustainability remains a significant challenge. Ultimately, the success of this Commission will depend on how effectively the government addresses these concerns while delivering on its promises. Comment what you think about the topic and keep following Suchak News for more updates.